- Home

- About us

- Expertise

-

-

Digital

-

Distribution

-

-

- Contact

- Blog

- +33 6 69 51 05 20

- Make an appointment

- Home

- About us

- Expertise

-

-

Digital

-

Distribution

-

-

- Contact

- Blog

- +33 6 69 51 05 20

- Make an appointment

The European regulation on digital operational resilience in the financial sector, also known as the DORA regulation (Digital Operational Resilience Act), is a European Union initiative aimed at strengthening the digital resilience of players in the financial sector.

With cyberthreats and attacks on critical infrastructures on the increase, DORA imposes strict obligations to ensure the security of information systems and guarantee the continuity of essential services.

DORA came into force on January 16, 2023, but affected entities have a transition period until January 17, 2025 to fully comply with its requirements. This period is intended to allow companies to review their internal policies, update their contracts, and ensure that all necessary compliance measures are in place.

DORA is more than just a legal framework: it sets standards that affect not only financial institutions, but also their information and communication technology (ICT) service providers.

As a result, the companies concerned must not only comply with the technical requirements, but also ensure that their contracts, internal practices and security policies comply with the new standards.

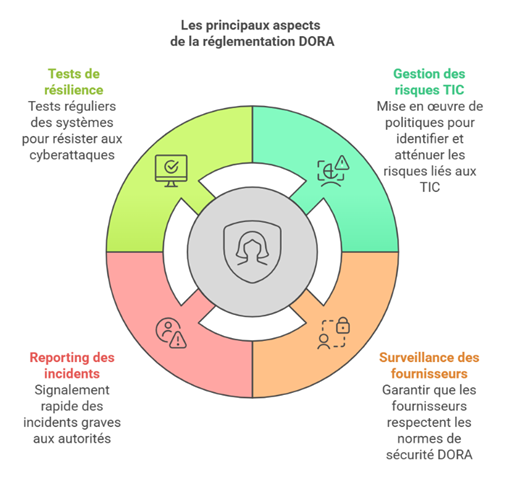

The DORA regulation aims to ensure that players in the financial sector, and their ICT service providers, can prevent, withstand and recover quickly from IT incidents. The framework is based on several key pillars that impose specific obligations:

Specialized legal support can help to analyze each of these requirements in detail and ensure optimum compliance with the DORA regulation.

DORA compliance requires a structured approach. A lawyer can guide you through the following steps:

However, compliance with DORA regulations is not limited to initial implementation: it requires ongoing monitoring and regular adjustments to keep up with requirements. This involves several essential actions.

First of all, we need to analyze regulatory developments, as DORA regulations may be amended or clarified by delegated acts, such as RTS (Regulatory Technical Standards). A lawyer will ensure that your company remains up to date with these changes.

Secondly, the implementation of a monitoring plan is crucial to integrate regular checks to ensure compliance of processes, policies and contracts.

Last but not least, we need to prepare for external audits, which means organizing the required documents and effectively structuring responses to regulators' questions.

Practical tips for successful conformity assessments :

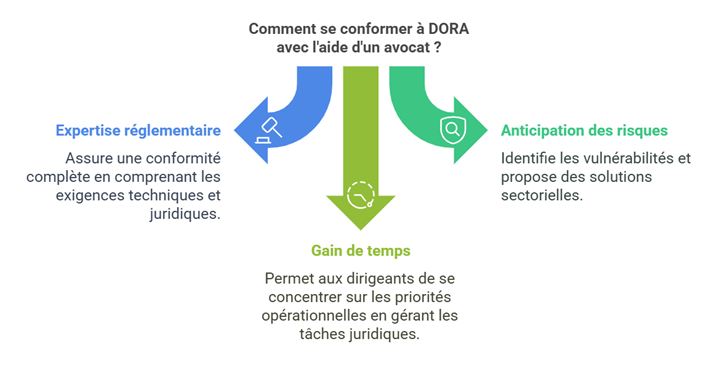

Benefits of legal support for DORA compliance:

Complying with DORA regulations is a crucial step in protecting your business from cyber threats and ensuring the resilience of your digital operations. However, compliance can be complex and require specific skills. Calling in a lawyer offers several advantages:

DORA regulations cover highly technical and legal areas, including cybersecurity and ICT risk management. A lawyer trained in financial and digital regulation understands the specific challenges of the financial sector and can tailor his advice to your unique needs.

➡️ Proactive DORA compliance is essential to avoid penalties and ensure business continuity. Contact a lawyer for a personalized audit.